With Blockchain having become the go-to word over the past few years, many organizations are looking at integrating blockchain without considering whether their products essentially require implementation of blockchain.The total consumer market for blockchain, according to markets and markets, will reach more than $7.5 billion by 2022, a rise of around 30.81% from 2016.The craze around the word “Blockchain” is evident from the following incident. According to Bloomberg, Long Island Iced Tea company changed its name to Long Blockchain Corporation after it received a warning from NASDAQ in October. Nasdaq confirmed delisting of the company unless its valuation rose above $35 million for 10 consecutive days. After the company changed its name, it saw its valuation rise to around $70 million.For some companies, Blockchain is just a fancy technical word, inclusion of which would help them in their marketing and increasing their product profile while for some it is an essential technology that will benefit their company/product in some way. This article takes a look at why many businesses are running towards blockchain.

A ray of hope for financial companies:

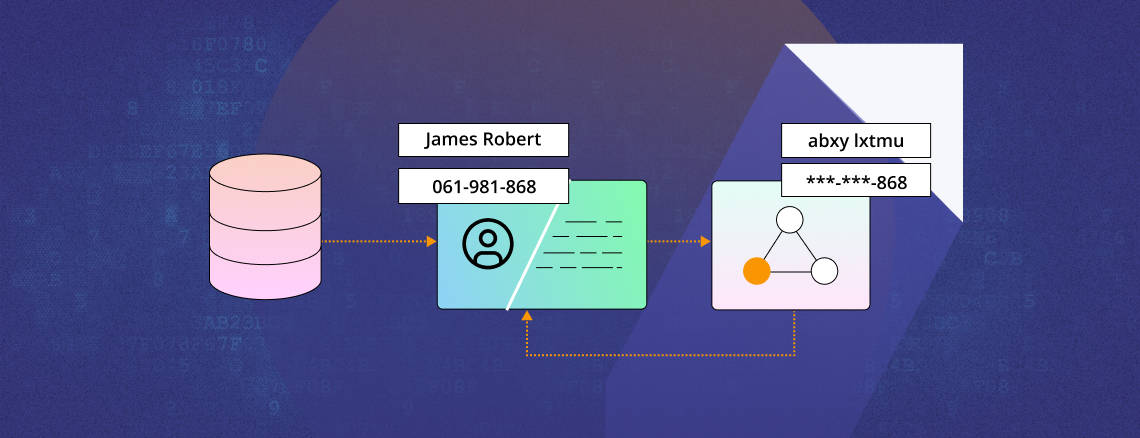

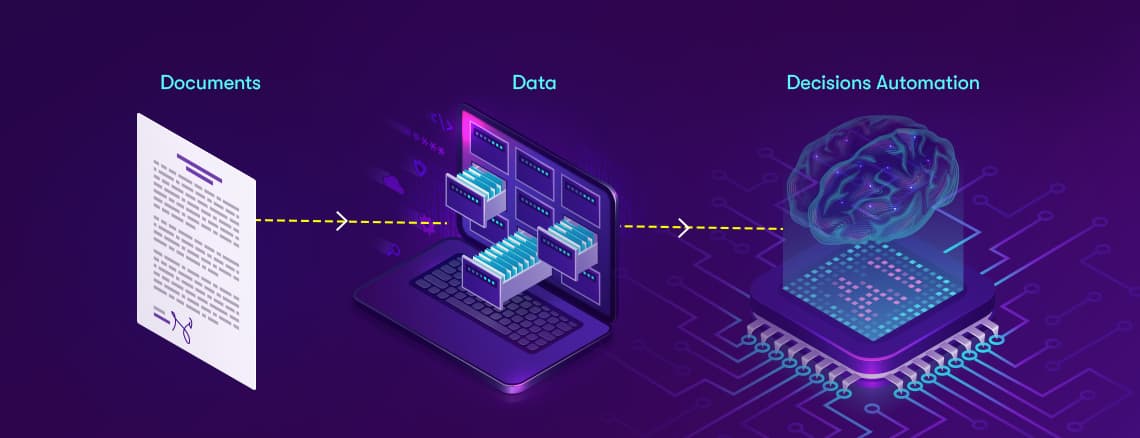

Banks are currently trying to move from a customer interfacing position to a paperless process. All financial companies are pushing their customers to move towards online banking with added incentives such as zero transaction fee, etc. Systems are being digitized and automated, causing the real world to recede. Banks are able to view the cost benefits from this automation but fear the actual loss that they might face due to lack of compliance or security.The maintenance of their online system needs an endless pool of investment. Maintenance of the system is an ongoing process that needs constant addition of features to maintain them along with heavy penalties which need to be paid when the bank fails to keep their systems secure. Recently, Britain’s HDFC bank paid $1.9 billion as settlement for failure to hande accusations on money laundering.At the same time, Australia’s largest four banks have also estimated to launder around $5 million in drug money. Failure to perform basic due diligence will likely cause these banks to fail the “Know your Customer” requirements.Australian laws prevent banks from informing customers in case they are reported to Austrac. However, this can lead to scenarios wherein a launderer could make around 100 suspicious deposits into an account within one day.Instead of overcoming all the potential loopholes and creating a system that will permit banks to confirm the identification of the end customers, banks can now use blockchain and its ingrained capability to conform to compliance and security measures by focussing on the identity. Identity maintenance is the distinct selling advantage of blockchain. This particular feature has led to widespread adoption of blockchain by companies such as Microsoft. Microsoft has recently become a part of ID2020 as a founding member and has joined hands with other tech companies at the Decentralized Identity Foundation. Ethereum and its platform based coins have also recognized ID verification as one of the major needs of the current time and its major feature as well.Identity verification is the basis of KYC and a complete ID verification and management solution becomes the basis for compliance and security. This is expected to bring enormous savings in the background.Some of the possible avenues in which blockchain is disrupting old fashioned businesses and impacting markets in 2018 are as mentioned below:Real time automation:Blockchain is often majorly known for its ability to maintain contracts and automate processes. It’s intelligent contracts are often well known and referred to as smart contract. Implementing blockchain to replace for multi level processes will save large cost and man-hours across business sectors impacting their bottom line.Similarly, blockchain can automate sourcing, supply chain, payroll processes, etc. by tracking the responsibilities and making each party accountable for their part of the transaction. This is expected to disrupt the way that marketers deal with services as of now.Automation will also reshape the relationship between customers and businesses. With contracts having specified deadlines and timeframe, each party will need to keep up with their part of the deal in order for the contract to get automatically executed and the payments to be automatically made.Evolution of startupsThe buzz around blockchain is expected to create a dot com craze with multiple small companies jumping onboard to service projects and work that deals with blockchain. Many forward looking organizations are expected to showcase their expertise in the field of blockchain and move its services activities towards blockchain. For the marketing industry, this will be the largest field of interest since 1900s.This buzz alone has led to the inclusion of blockchain across many corporations. What we need to consider at this moment is whether our product or service truely demands any of the benefits presented by Blockchain and it would lead to any incremental benefit in the system.Kodak has also stepped into the space and has launched the KodakCoin.Some big players in this arenaBig corporations like Amazon and Starbucks have recently expressed interest in including blockchain and cryptocurrency into their payment system. IBM has also contributed code to an open source effort and is encouraging startups to try the technology on its cloud for free.With multiple parties having the ability to use the same blockchain, corporations such as IBM are revising the policies that were originally used to compensate its sales associates. In the past sales reps got compensated whenever their clients purchased IBM technologies directly. However, now sales reps are expected to receive a commission when clients encourage other companies to join them on blockchain as well and use IBM’s systems and services.Additionally, according to a Juniper Research survey almost six out of ten largest corporations are contemplating using blockchain. The field is getting interest from companies such as Walmart Stores. Inc. and Visa Inc. which are looking at streamlining their supply chain, speed up payments, and store records. The display of interest in blockchain shown by such large companies has piqued the interest of smaller companies and players as well who have wholeheartedly taken to adopting it. Read Why Blockchain matters to small companies.There is no doubt about the fact that the field of Blockchain will see a rise in the forthcoming future. The only question is how far that future would be.

.png)

.png)

.webp)